In the summer of 2012 Supervisor Pat Herrity, who recently I had the opportunity to sit down and talk to, stated that the new requirement for 20 percent of all new dwellings developed in Tysons to include Workforce Housing, would cost the County $500 million dollars. We have been covering the issue of workforce housing in a multi-part series, to help define what it is and who it applies to. The program does not directly purchase or subsidize housing for residents, but instead requires a reduction in the market price for the 20 percent.

There are a lot of ways for a developer to meet the requirement with many variables involved. The number of bedrooms: efficiency, 1 bedroom, or 2 bedroom is an important factor as well as the percentage reduction applied. The requirement has three tiers in pricing, one that is based on 80% of the county median income, one for 100%, and one for 120% which are split evenly into thirds. There is nothing keeping a developer from pricing all of the units at 80% (for less money) but in reality the minimum requirement will be more likely (1/3rd for 80%, 1/3rd for 100%, and 1/3rd for 120%). Additionally, while a developer could build all studio units, due to the reduction factor towards meeting the requirement (studios equivalent to only 70% of a 2 bedroom), it is likely that most of the affordable units will be split evenly in 1/3rds between studio, 1br, and 2br types.

“We are artificially capping the rental rate, so we are also artificially capping the tax base” says Supervisor Herrity. “The role of Government in housing is to help people get back on their feet and off the government roles, and to help those who can’t help themselves like the elderly and disabled.” It is hard to argue with that statement, because with limited budget capacity any money that is reduced from possible tax revenue by rental capping does in turn reduce the viability of other social programs.

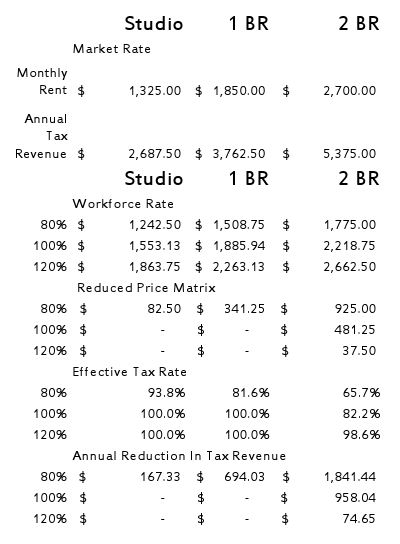

In the previous post we calculated the price for each type of housing for each given income tier and compared this to the going market rate. So in aggregate, from now until Tysons 2050, what will be the cost on our county’s budget because of the rental caps?

It’s a bit more complicated than the Supervisor indicated in his back of the envelope calculation. First of all, as of right now there are no new buildings built based on the new requirement. The entire idea of Tysons is a 30 to 40 year build out. Because tax assessments are one part how much, and one part how long. A building built in 2040 will reduce the amount of possible tax revenue to the county far less over the course of time than one built and occupied next year. So in order to accurately gauge the reduction in tax revenue one must first interpret how quickly the build out will occur.

Today there are 19,000 residents in Tysons, and by 2050 that number will rise to 100,000. The average anticipated occupancy of the new units will be two residents per unit, therefore we can anticipated out of the 81,000 new residents there will be 40,500 new dwelling units. Out of that total number there will be 20% or 8100 workforce housing units.

The following matrix shows the effect of the workforce pricing on market rate. Assuming that within the matrix there are 9 workforce housing options, each will constitute 1/9th (900 workforce housing units each) of all workforce units. You can see that each of these options have variance on their impacts to the effective tax revenue received.

If all of the units existed, then the impact in any given year would be $3,361,000; that is a sizeable amount of money and definitely something that should concern tax payers and budget officials. But even if we assumed that from 2014 to 2050 that all of the new buildings will exist for the full 36 years, that would result in a total public cost of $121 Million, a quarter of Supervisor Herrity’s estimate of $500 Million. That is also wildly unrealistic, after all 40 million square feet of residential development is not going to pop up next month.

Given three different scenarios, even linear construction growth of residential units, an early accelerated construction growth, and a delayed later construction growth, the county loss of revenue will vary greatly. One thing is evident, the realistic cost of providing market modified housing is far, far less than $500 million dollars between now and 2050.

- Linear growth, total 36 year effective cost of $65.5 million, average annual of $1.82 million

- Accelerated growth, total 36 year effective cost of $78.8 million, average annual of $2.19 million

- Slow growth, total 36 year effective cost of $48.6 million, average annual of $1.35 million

Although the effective budget impact of workforce housing is less than the stated $500 million, it still is a sizeable amount which equates to removing services from other parts of the budget. However, Tysons itself will be bringing huge amounts of new tax revenue into the County, counter balancing those costs, therefore this really isn’t a cost to today’s budget but instead a cost to the possible future revenue. If no workforce housing was required the total possible revenue over the next 36 years would be;

- Linear growth, total 36 year tax revenue of $3.11 billion, average annual of $86.4 milion

- Accelerated growth, total 36 year tax revenue of $3.74 billion, average annual of $103.9 million

- Slow growth, total 36 year tax revenue of $2.31 billion, average annual of $64.2 million

The resultant cost is therefore approximately 2 to 3% of the tax revenue that could have been possible.

What is lost in the hyperbole and the resultant political rebuttal is the question of is this method of market modification really the most effective use of government focus? Often times rent control ends up being manipulated and mis-used to rip off the public, opening this can of worms shouldn’t be taken as an easy course of action.

The net result of this policy might not be as costly as indicated by Supervisor Herrity, but we should question the effectiveness and possible future controversies that will be inevitable.