One of the largest problems with densifying suburban edge cities and urbanization is the inherent sudden unaffordability. This rise of retail/office/residential rates creates corporate atmospheres as these are the only entities capable of paying the “new car smell” fees. Why do prices go up? When you just completed a $350 million dollar construction project your financing company generally wants to see their money back… or else. Managing companies must make this back at the highest possible rate that the market will bear, which often means selling their soul to the highest bidder. Often outrage at this systematic and cyclical conflict is focused on the residential side of development, but it is the retail space which really sets the pace of what a growing city will become.

One of the largest problems with densifying suburban edge cities and urbanization is the inherent sudden unaffordability. This rise of retail/office/residential rates creates corporate atmospheres as these are the only entities capable of paying the “new car smell” fees. Why do prices go up? When you just completed a $350 million dollar construction project your financing company generally wants to see their money back… or else. Managing companies must make this back at the highest possible rate that the market will bear, which often means selling their soul to the highest bidder. Often outrage at this systematic and cyclical conflict is focused on the residential side of development, but it is the retail space which really sets the pace of what a growing city will become.

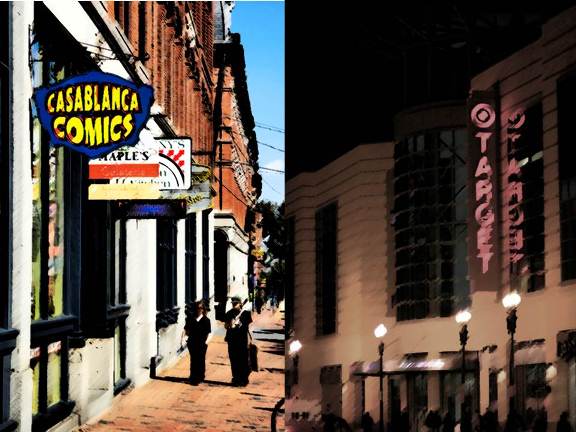

Unfortunately rates of $55 to $65 for retail spaces and above $100 per square foot per year becomes a cumbersome overhead price that all but removes the competitiveness of small businesses. Instead expansive spaces become absorbed by retail franchises which lack community identity and entrepreneurial possibilities. While these companies provide employment for many, their profits often are shipped off to headquarters and removed from the local circulation. It becomes a double impact to local commerce where start ups and residents are both priced out of the market and the community is rendered sterile. When confronted with this inevitable alteration to an area residents often become obstructionist to any new development. While this method temporarily works in maintaining the local fabric, it eventually trades one form of unaffordability for another. Inventory remains stagnant causing demand to outpace supply and raising rates. Additionally outside investment is sent elsewhere which after a couple of decades of mismanagement creates the situations that many brick and mortars now face, most notably Springfield Mall.

The solution isn’t to put ourselves in a time capsule, but to find solutions to these problems through innovation. An unresponsive and lack of willingness to evolve is what will create a corporate vegas/disneyland fake city. We must find ways of retaining local businesses and franchises in a healthy balance. The flexibility of how retail space is arrange is an important architectural design style that often falls out of priority in order to provide an aesthetic spacing for doors along a facade. Instead of designing a building at street level to be monotone and repetitive, we should encourage a variance of retail spaces in size and manner which provides a mix of pop-up sized, small, med, and large (franchise) spaces. The space price per square foot is unaltered by this arrangement. A small business that wants a presence in high traffic pedestrian zones could accomplish this with a 400sf space and maintain a price per month of $2000 and provide a small show case supplemented by support space outside of this very expensive zone or electronic displays of merchandise.

The solution isn’t to put ourselves in a time capsule, but to find solutions to these problems through innovation. An unresponsive and lack of willingness to evolve is what will create a corporate vegas/disneyland fake city. We must find ways of retaining local businesses and franchises in a healthy balance. The flexibility of how retail space is arrange is an important architectural design style that often falls out of priority in order to provide an aesthetic spacing for doors along a facade. Instead of designing a building at street level to be monotone and repetitive, we should encourage a variance of retail spaces in size and manner which provides a mix of pop-up sized, small, med, and large (franchise) spaces. The space price per square foot is unaltered by this arrangement. A small business that wants a presence in high traffic pedestrian zones could accomplish this with a 400sf space and maintain a price per month of $2000 and provide a small show case supplemented by support space outside of this very expensive zone or electronic displays of merchandise.

Small business owners are not in control of this ability often, therefore management companies guided by the plan process should consider these arrangements as in the long run it helps all parties. We can do more with less in all facets and technology is helping lead the way. Land use itself can also be a tool to encourage small business. Stringent and dated requirements that separate retail and residential uses are anti-productive. The genesis of these standards is to reduce noise and nuisance to residents who in suburban regions can be disturbed by heavy foot traffic and business operations. This isn’t necessarily an issue when residential units have high rise structural walls, sound proofed windows, etc.

Fairfax County in many ways has already conceded that both uses can co-habitate with allowances for street level retail in residential towers, but what about provided duel use units that allow a shop front to a residential rear space. One of the best ways to reduce the cost to run a business could be to merge it with the cost of living and renting an apartment. A 200-400sf front which can help a new artist or 1 person shop could include a 500sf studio residence behind the separated wall. The rates would be a mix of residential and retail, in the range of $45 per sqft, and therefore range between $2600 and $3000 per month. If this was just a retail space then it would simply be too much for many small businesses, but renting a studio in Arlington and NOVA can often run a cost of $1500 as well. Therefore the effective retail rate is reduced to $1100 to $1500 per month, a figure that is much easier to overcome.

If we continue the current policies we will convert all of our prime retail spaces into corporate yuppie zones that make money for a select few but kill the American dream. There are entrepreneurs in this country still, but they are being pushed further and further from places that could sustain their business models, and being forced to strip malls that see less than 1% of the traffic conversion rates of walkable areas. The only impediments to returning small business to main street is our own unwillingness to adapt to the times.

If we continue the current policies we will convert all of our prime retail spaces into corporate yuppie zones that make money for a select few but kill the American dream. There are entrepreneurs in this country still, but they are being pushed further and further from places that could sustain their business models, and being forced to strip malls that see less than 1% of the traffic conversion rates of walkable areas. The only impediments to returning small business to main street is our own unwillingness to adapt to the times.