The annual Tysons real estate summit by Altus Group recently happened on a foggy morning in Tysons at the Silverline Center. The annual meeting is a panel discussion of speakers from leasing experts, to county staff, and private developers. The speakers this year were Stephen Cumbie of NVCommercial, Moe Hamilton of Cushman & Wakefield, James Policaro of Lerner (perhaps some information regarding the residential tower status and plans), and Fred Selden of Fairfax County Planning.

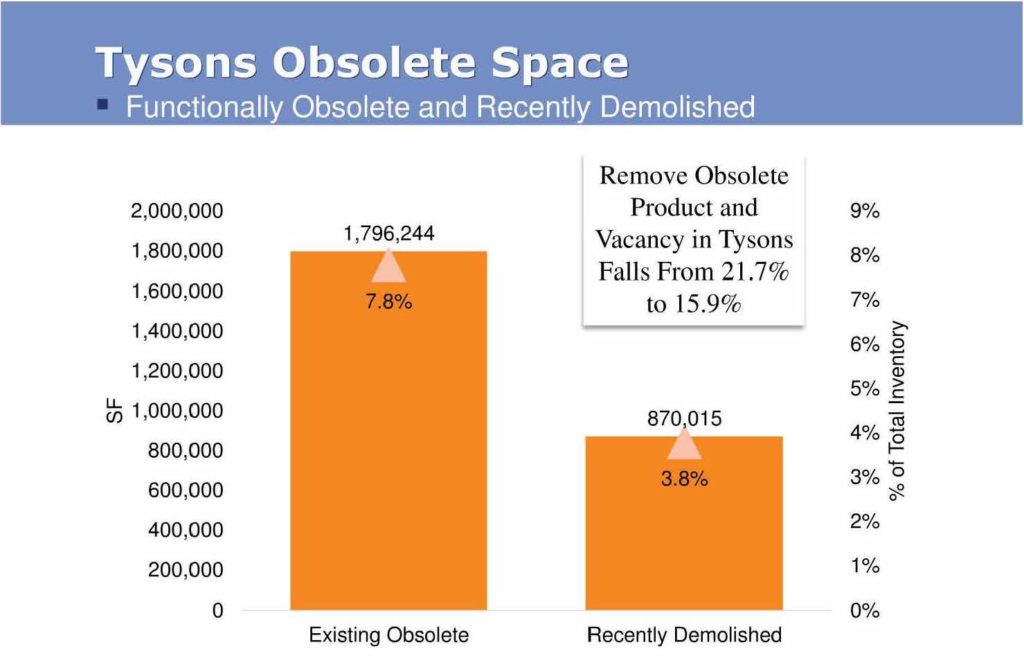

Some very interesting statistics came out of the discussion. Since 2010, Tysons as a subarea has outpaced not only Fairfax County, but D.C. itself, in terms of residential growth as a percentage, averaging 14.32% since that time. Commercial vacancy rates, while still above the long term average for Tysons of 16%, is lower (15.9%) when obsolete offices ready for renovation or demolition are factored in. When looking at prime locations, nearest to metro, the vacancy in Tysons is only 7.2%.

The steady vacancy, and availability of varying ages of buildings, has also stabilized commercial rates in Tysons. The average asking price for office space remains at the same levels as 1999, while at the same time office tenants are actually getting more concessions on signing. The vast majority of office absorption, over 70%, is occurring in small business spaces. That means startups are having a historically easier time in acquiring office space.

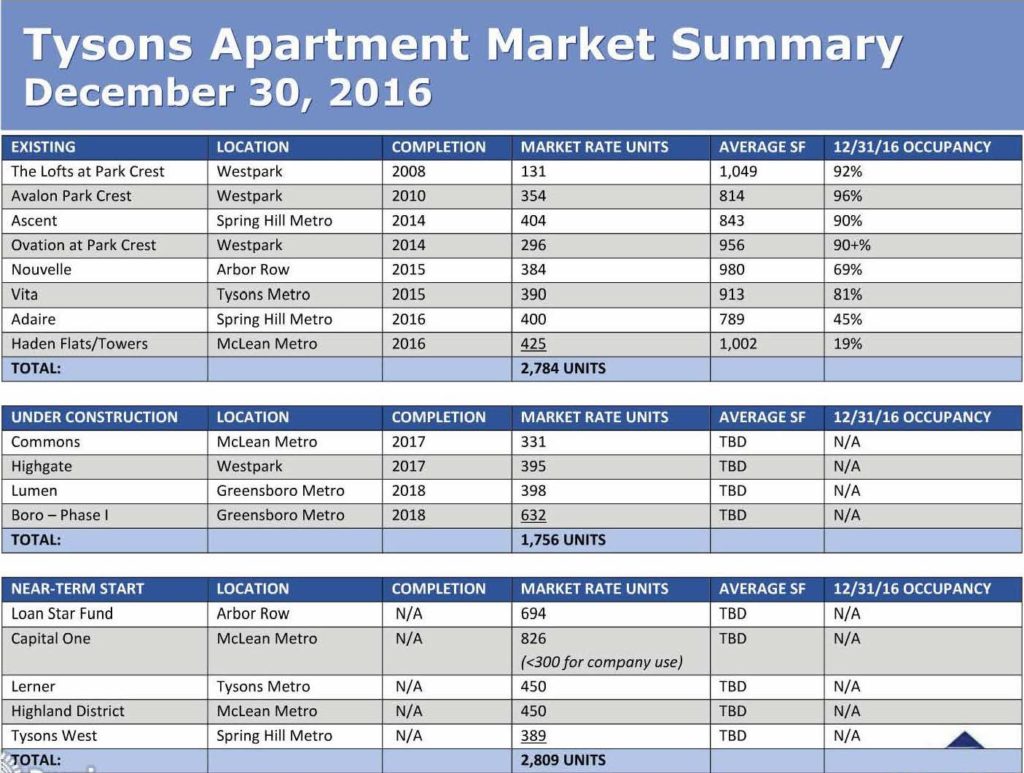

We also received some great updates from NV’s Stephen Cumbie, including some apartment vacancy rates. Many of the apartments built between 2010 and 2013, such as Ovation and Ascent, now have over 90% occupancy; showing extremely healthy conditions for more multi-family construction. Newer buildings (within the past two years) like Nouvelle (69% occupied) and Vita (81% occupied) are meeting critical thresholds.

Even brand new apartments like the Adaire, and the Haden which has only been leasing for a couple of months, have started to fill up. Speaking candidly, Cumbie noted that after speaking to many managing companies and construction partners, they have found no hesitance to building multi-family apartments from the County’s ambitious 20% Workforce Housing requirements.

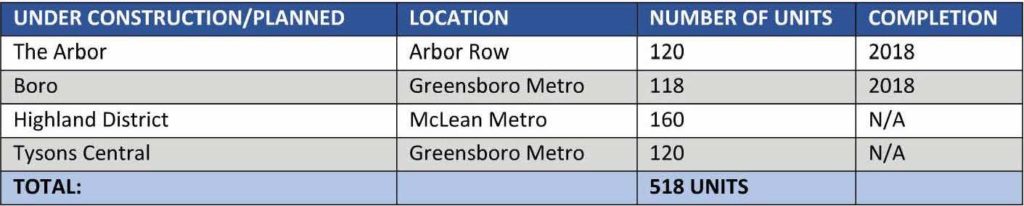

The subject of condominiums, always something of interest, came up as well. Many of the panelists agreed upon the problems that are holding condominiums back, high risk, financing, and difficult logistics regarding affordable housing, to name a few. They also agreed that the market was finding a means to still bring condominiums to interested buyers, through smaller sized buildings that offer 100 to 150 units instead of many high rise apartments which provide up to 400 units per building. Projects like the Boro and Arbor Row will provide good data points on the future of condominiums in Tysons, and may deliver by early 2019.

Overall, the event was another informative session of those in Tysons who make decisions which will guide its growth over the next 25 years. Hearing directly from developers, county planners, and commercial real estate experts provides insight in the potential and the constraints affecting America’s next great city.