The differences between traditional subsidized housing, Workforce Dwelling Units (WDUs) and Affordable Dwelling Units (ADUs) are substantial, as we noted in part 1 of our look at market modified housing policies.

Firstly, WDUs are not necessarily in order to provide low income housing, as can be seen by the range for eligible applicants. WDUs are intended for households <80% up to a maximum of 120% of the regional median income (a little over $100k) where as ADUs are eligible to only households with less than 70% of the median household income of the region.

A new development in Tysons is required to equally spread rental pricing across three tiers with WDUs, unlike ADUs. The tiers are up to 80%, up to 100%, and up to 120% (in other words 6.67%, 6.67%, and 6.67% of all units, totaling 20% of provided, are adjusted accordingly).

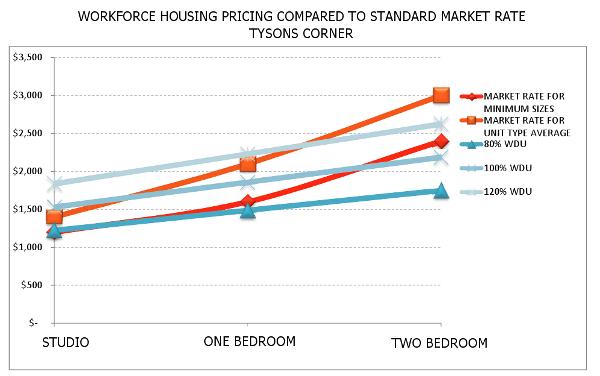

Once the dispersion range of incomes is set, the pricing allowed for rental is a bit more complicated. So let’s look at the average case, a family making 100% of the regional median income wants to rent a 2br apartment. The rental price would be about $2200 per month to be paid by that household based on the equation;

(Income Tier [must be 80%, 100%, or 120%] / 12 x 0.25) x housing type adjustment

For a 2br apartment, and a household making 120% median income, the rental price would be $2625. In other words all units are not required to be reduced for pricing towards the lower bracket (only 1/3rd of the 20%).

For a 2br apartment for someone making 80% median income the rental price would be $1750.

As can been seen above, WDUs will not provide any housing options to low income or unemployed residents. Indeed WDUs are a government policy to ensure that the growing city of Tysons will not include only units renting for $3000. Whether it is the role of the government to control this dynamic, or in what way, remains a question.

To understand what the effect on the market rate would be, one has to review what a comparable unit would be priced. The developer is only required to build units of the following minimum size: studio of 450sf, 1br of 600sf, and 2br of 750sf. It is notable that these sizes are far smaller than typical: studio of 600sf, 1br of 850sf, and 2br of 1000sf.

In general the effect on the market rate that would have been charged for those units is reduced as much as $1250. However, many of those units that apply as WDUs would still rent for market rate.

A reduction in the rent charged is a ghost loss paid for by the developer who otherwise would have charged the full market rate and as noted by Supervisor Herrity “We are reducing the potential tax revenue possible from those units.”

This is an accurate statement in that the overall tax assessment for a building will be reduced to reflect the lower produced income for the developer from the 20% of the units that are WDUs per the County’s own tax base calculus.

So what is the cost to provide WDUs in Tysons? In part 3 we will take a look at the effective public cost, in lost tax revenue, from the Tysons WDU requirement.