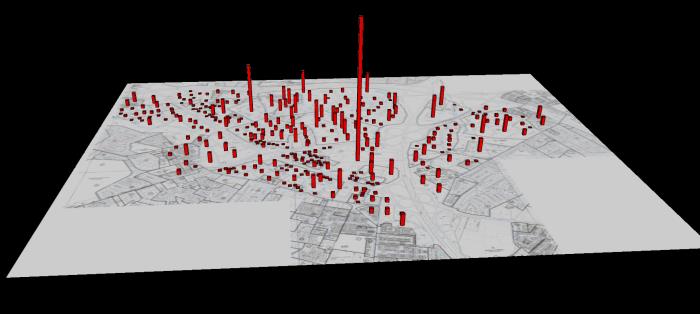

In an effort to bring more data and visualization for public information we have been busy creating a database of tax records for each of the parcels within Tysons Comprehensive Plan District. We then thought it would be fun to play with the data by over-laying the assessment with a vertical bar which represents $250,000 in tax assessed value per vertical foot.

Its no surprise that the Tysons Corner Center (the mall) is the highest assessed property in Tysons; in fact it’s the highest assessed parcel in the entire Washington Metro region, and the only above $1 billion. I was personally shocked just how much more the parcel is worth than all the others in town. A close second is the Rotonda coming in at $420 million with all units combined.

If one were to combine all of the Tysons 2 properties (the Ritz, Galleria, and the half dozen or so offices) they would also exceed $1 billion in assessed value.

It is also interesting to see the seriously under valued area around Westpark and Jones Branch where many of the buildings are quickly aging and out-living their marketable cycle. It is not shocking that these are also the properties most likely to be redeveloped, as is evident by the Arbor Row redevelopment and now a new project by PS Business Parks.

Rounding out some notable mentions are the major headquarters of Fortune 500’s Freddie Mac ($210 million), Gannett ($184 million), and Hilton Worldwide ($103 million).