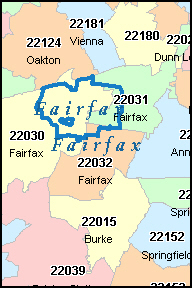

One of the strangest conversations a Fairfax resident often finds themselves in is “where do I live?” We’ve all grown accustomed to defining our regions one way or another, by school district, geographic designation, postal definitions, and in very rare cases in Northern Virginia, by township or city incorporation. I remember as a child I thought of myself as a Springfield resident, even though I attended Lake Braddock High School where 95% of students were from Burke. When my parents moved to a new house ten years ago, they suddenly became Burke residents, by moving 1 mile west. Of course anyone who has lived in Burke or Springfield knows just how nebulous these definitions are.

One of the strangest conversations a Fairfax resident often finds themselves in is “where do I live?” We’ve all grown accustomed to defining our regions one way or another, by school district, geographic designation, postal definitions, and in very rare cases in Northern Virginia, by township or city incorporation. I remember as a child I thought of myself as a Springfield resident, even though I attended Lake Braddock High School where 95% of students were from Burke. When my parents moved to a new house ten years ago, they suddenly became Burke residents, by moving 1 mile west. Of course anyone who has lived in Burke or Springfield knows just how nebulous these definitions are.

In the absence of a geographic definition, regions such as West Falls Church, Merrifield and Tysons Corner have developed out of the recognized towns/cities Falls Church, Vienna, and McLean. The reality is that almost all Fairfax County residents are living in unincorporated Fairfax County. Unfortunately this arrangement provides greater control to State planners and policy makers in Richmond, instead of local planners who could make decisions that best meet resident preferences.

Existing Benefits of Being an Incorporated City

- Incorporated Cities in Virginia typically receive between $10,000 and $17,000 per lane mile of road. Counties only receive approximately $6,000 per lane mile.

Cities own their roads and therefore attain design and maintenance responsibilities. This allows cities greater control on how to spend operational funds and design efficiencies such as reduced lane width, traffic calming like low speed rumble strips and urban intersection designs that promote multi-modal usability. This can also be used to create revenue from those who use infrastructure within the city but do not live within the city through the use of toll zones and parking assessments, see the successful London Congestion Zone Charge, or through the sale of air rights to private development.

Cities own their roads and therefore attain design and maintenance responsibilities. This allows cities greater control on how to spend operational funds and design efficiencies such as reduced lane width, traffic calming like low speed rumble strips and urban intersection designs that promote multi-modal usability. This can also be used to create revenue from those who use infrastructure within the city but do not live within the city through the use of toll zones and parking assessments, see the successful London Congestion Zone Charge, or through the sale of air rights to private development.- Cities have the ability to excise a variance of local fees beyond real estate taxes, with the exception of income taxes.

New Benefits of Being an Incorporated City (Via Federal Transportation Bill)

- Attain 50% of formula federal funding per capita for a specific region in need of bike and pedestrian infrastructure.

- Attain a higher likelihood of attaining grants from federal sources due to a narrower definition of the municipality which would increase per capita improvement impacts. In other words, in a County of 1 million people, a project that only helps 50,000 might be seen as wasteful and without impact. In a City of 200,000 people, a project that helps the same number of people would be seen as important and wide reaching.

- Independent definition of a regional transit and transportation department which can attain funding from Federal sources for BRT and similar transit projects without going through the State. This will avoid competition with projects within other regions of the state that would ultimately be decided by the State and subject to political preferences.

Politics makes strange bedfellows, and it is odd that in this case the smart growth groups could be aligned with Republican leaders who want greater responsibility to be provided to more local jurisdictions. Unfortunately the GOP in Virginia wants to eat their cake and have it too by suggesting Counties take over their road funding and yet not take over the ownership of these roads, essentially granting Richmond tens of thousands of acres of free and operationally maintained land in the most expensive parts of the state. Incorporation sidesteps that restriction. Ironically in order to become incorporated within the State of Virginia you must be granted a charter by, who else, the State of Virginia.

The only way to be granted independence from these controls is to wait until a more empathetic leadership is in place in the Statehouse. Until then the state will continue to reap 30-40% of it’s tax revenue from Loudoun, Fairfax, and Arlington while returning 6 to 8% of state funds to those same jurisdictions.