Developers, urbanists, and economists alike are about to see a large scale experiment in the laws of supply and demand that would perk the ears of Adam Smith himself. The DC metropolitan region faces a cost of living crisis which is making it nearly impossible for new middle income residents to find housing anywhere but the fringes of the region.

Developers, urbanists, and economists alike are about to see a large scale experiment in the laws of supply and demand that would perk the ears of Adam Smith himself. The DC metropolitan region faces a cost of living crisis which is making it nearly impossible for new middle income residents to find housing anywhere but the fringes of the region.

The question becomes, can thousands of new rental (and foreseeably some future to own) properties help taper the growth in costs, if not reverse the trend?

That is the scenario Tysons finds itself in, and the public and private parties involved in the process may soon receive some answers.

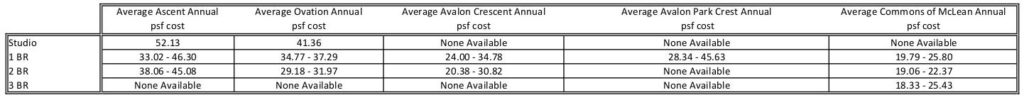

In February both Ascent (404 rental units) and Ovation (300 rental units) hit the market for prospective leasers. Both are significantly more expensive than the average rental price in Tysons, but that can be expected considering most other rental properties in Tysons are either mid-rise or garden style apartments, as well as being slightly older.

So what do their entry prices tell us? Well first of all, studio apartments really are not much bang for the buck, but then again they do set a more accessible entry price for people who can’t afford one or two bedroom apartments. Ascent has a much larger range of pricing, dependent on the location within the building vertically and floor layouts.

So what do their entry prices tell us? Well first of all, studio apartments really are not much bang for the buck, but then again they do set a more accessible entry price for people who can’t afford one or two bedroom apartments. Ascent has a much larger range of pricing, dependent on the location within the building vertically and floor layouts.

For one bedrooms Ascent has a nearly $2 edge at the lower end of the range against Ovation, but Ovation’s pricing is more congruent with a minimal variation regarding which floor you are on.

The real difference occurs with two bedrooms, which Ovation has priced with a market enticing lower end of about $29 psf making it less expensive than comparable units in the Rossyln-Ballston corridor, and a 20% increase over comparable units in Reston without metro.

I’m sure some at Ascent are worried about this downward pressure considering the lowest price for Ascent two bedrooms begins at $38 psf, almost $9 more per square foot, equating to a 30% markup, or approximately $1000 more per month.

I’m sure some at Ascent are worried about this downward pressure considering the lowest price for Ascent two bedrooms begins at $38 psf, almost $9 more per square foot, equating to a 30% markup, or approximately $1000 more per month.

Of course, Ascent does have the advantage of being closer to metro, but Ovation is within an existing neighborhood with a near-by grocery store and closer proximity to many of the offices where new residents are likely employed.

What does this mean? Downward pressure will likely require Ascent to find ways to reduce rent, which a recent motivator campaign for 1-month free rent has already somewhat done. By providing this trade method Ascent can maintain their advertised pricing, but effectively provide a $3 to $4 psf discount.

I believe what we are seeing is the law of supply and demand in full force, which is beneficial to consumers looking for a “live where you work” lifestyle. It’s yet to be seen whether reduced pricing (whether by special offer or lower rental rates) will discourage more development already in the pipe line by altering the calculus of project financing.

There’s only one economic rule more pertinent than that of supply and demand; if it’s profitable someone will build it.

* By request we have added some additional cost information for other non-high rise apartments onto the following list, though it is difficult to compare due to variance in finishes, reduction in some amenities, and variance in locations with proximity to metro.